When we went on our Boston to Ushuaia trip, we were still maintaining an apartment back in Boston. We had house-sitters living in our apartment and taking care of our dogs while we traveled. Between paying rent, paying utilities and paying on some debt we had, we were paying probably an additional $2,500 a month just to maintain our life back home. Over the four months of our trip, that added up to $10,000. That eats into your travel fund quickly, so part of the delay in planning for our around-the-world trip has been dealing with our intent to eliminate expenses at home.

Some people sell their homes to take a trip around the world. We intend to give up our apartment when we set out on our trip. We really want to take our time on our around-the-world trip, so we don’t want to have expenses back home draining our account and forcing us into a timeframe.

We’ve also been working to pay off debt before the next time we go. Kay has eliminated the debt he’s been carrying, and with our tax return this year, I’ve been able to eliminate most of mine. I’m down to one credit card, which we’ll pay off this year, and then we’ll be completely debt-free. It’ll be nice to not have the drain on our expenses back home, and it’ll also be nice to have a credit card with some room on it in the event of an emergency. That’s something we haven’t had for any of our prior trips, and it’ll give me a little peace of mind in the face of our inevitable breakdowns.

So from here on out, once we’ve paid off my last credit card, every penny we can save will go directly toward the trip. It’s a lot easier to save when the trip isn’t some abstract “sometime in the future,” but instead every dollar you put away translates directly to time on the road. Want to buy a new pair of shoes? That might fund a day on the road. That PS4 I got for Christmas? Could have funded three days of travel. When you can make a direct correlation between money spent and time on the road, it’s a lot easier to think critically about every purchase you make.

We will still have some expenses, because we don’t intend to give away or sell all of our possessions when we hit the road - we’ll do a storage unit (probably a POD in case we decide to settle somewhere else when we come home), and we expect to spend around $400 a month on that. But that’s a far cry from the $2,500 we were spending on our Boston to Ushuaia trip.

I’ve been pondering that we could try to find a cheap house somewhere in New England, whose mortgage would be around $400 a month, and store the few things that we don’t want to get rid of there. This route would have the added benefit of not having to worry about the added expense of finding housing when we get home. But there are a lot of hidden costs tied up in owning a home that I worry would detract from our travel fund. (Maintenance, taxes, homeowner’s insurance, inevitable unforeseen expenses.)

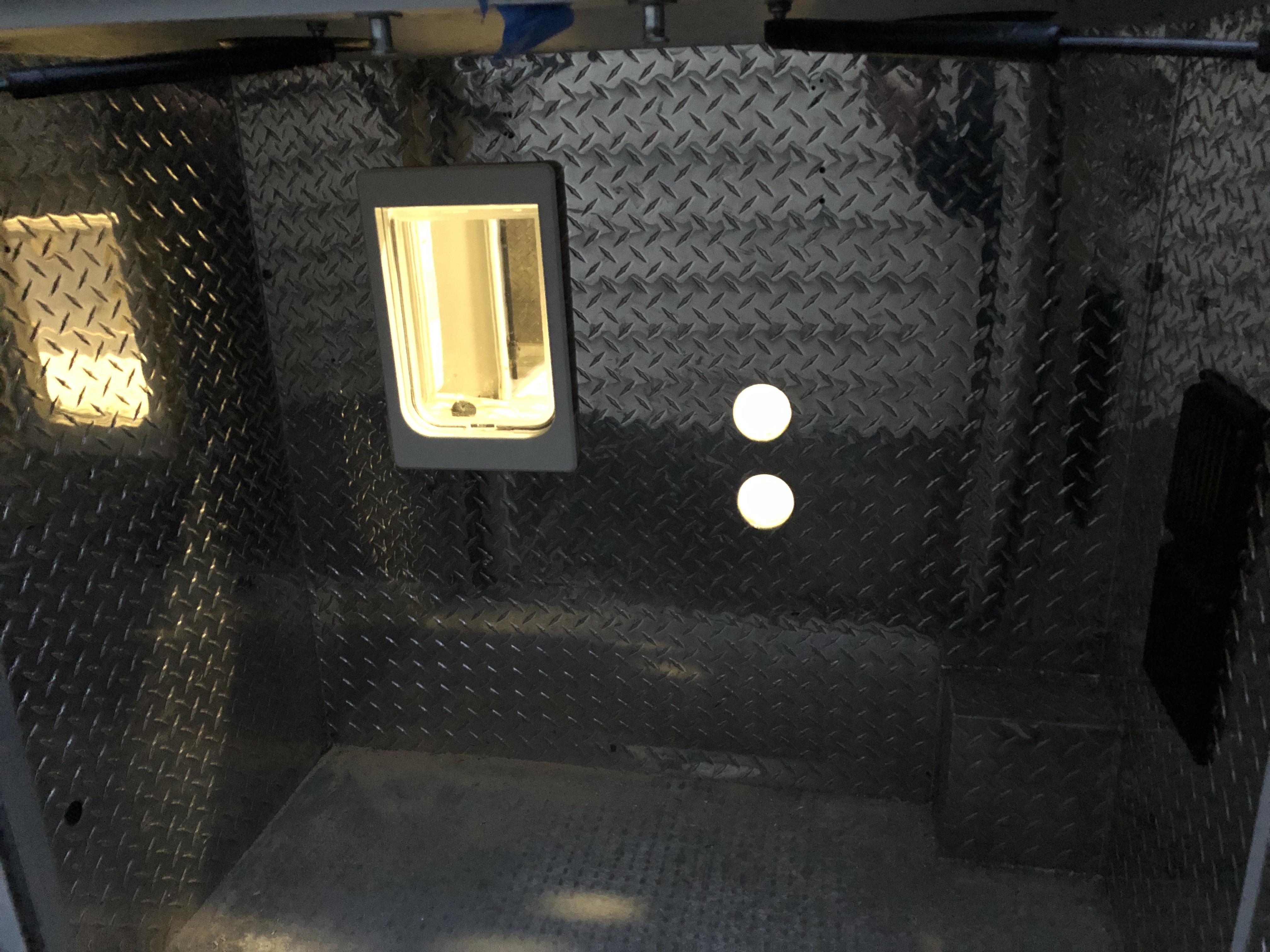

Anywho, between eliminating these expenses, experimenting with our vehicle options (the Ural, the Vanagon) and everyday life stuff taxing our checking accounts, it’s been longer than we’d have wished back in 2011 before getting back on the road. But it’s definitely in the works - we’re just looking at a much bigger picture this time around. We haven’t lost site of the prize, but we’re trying to arrange things so that the next trip can be as long as we want it to be.